1 In 6 People Are Affected By Infertility, But No One Talks About it

Fertility fog is not just a cultural problem & Fertility-tech is on the rise

Approximately 17.5% of the global adult population, equivalent to roughly 1 in 6 individuals, grapple with infertility, underscoring the pressing necessity to enhance the availability of affordable, top-notch fertility care for those seeking assistance.

Infertility, characterized as a disease impacting the male or female reproductive system, is marked by the inability to conceive after 12 months or more of consistent unprotected sexual intercourse. This condition can lead to considerable emotional strain, societal stigmatization, and financial burdens, profoundly impacting the mental and psychosocial well-being of those affected.

The Problem

Despite the significant impact of infertility, viable solutions for prevention, diagnosis, and treatment, including assisted reproductive technology like in vitro fertilization (IVF), suffer from insufficient funding and limited accessibility. These challenges arise from high costs, social stigma, and limited availability, hindering many individuals from accessing the care they need.

Currently, in most countries, fertility treatments largely rely on out-of-pocket funding, resulting in overwhelming financial burdens.

The Market

The fertility services market is expected to grow to $90.14 billion in 2027.

The market growth is primarily fueled by the increasing trend of reproductive tourism and the surging number of male and female infertility cases. Infertility poses a significant health concern for individuals worldwide, with the World Health Organization (WHO) estimating that approximately 8%-10% of couples, equivalent to around 80 million couples globally, are affected by infertility.

In recent times, various family-planning issues have gained prominence:

The economics surrounding infertility treatments remain veiled in opacity, and the extent of insurance coverage varies significantly between countries and providers.

The disparities within the industry disproportionately impact LGBTQ individuals, those with lower incomes, and people of color.

What Does the Data Reveal? Insights into Fertility Trends and Realities

The pandemic spurred a surge in women opting for egg freezing, with egg freezing cycles in the UK experiencing a remarkable 64% increase between 2019 and 2021.

In the UK the average patient age increased to 36 for patients undergoing IVF

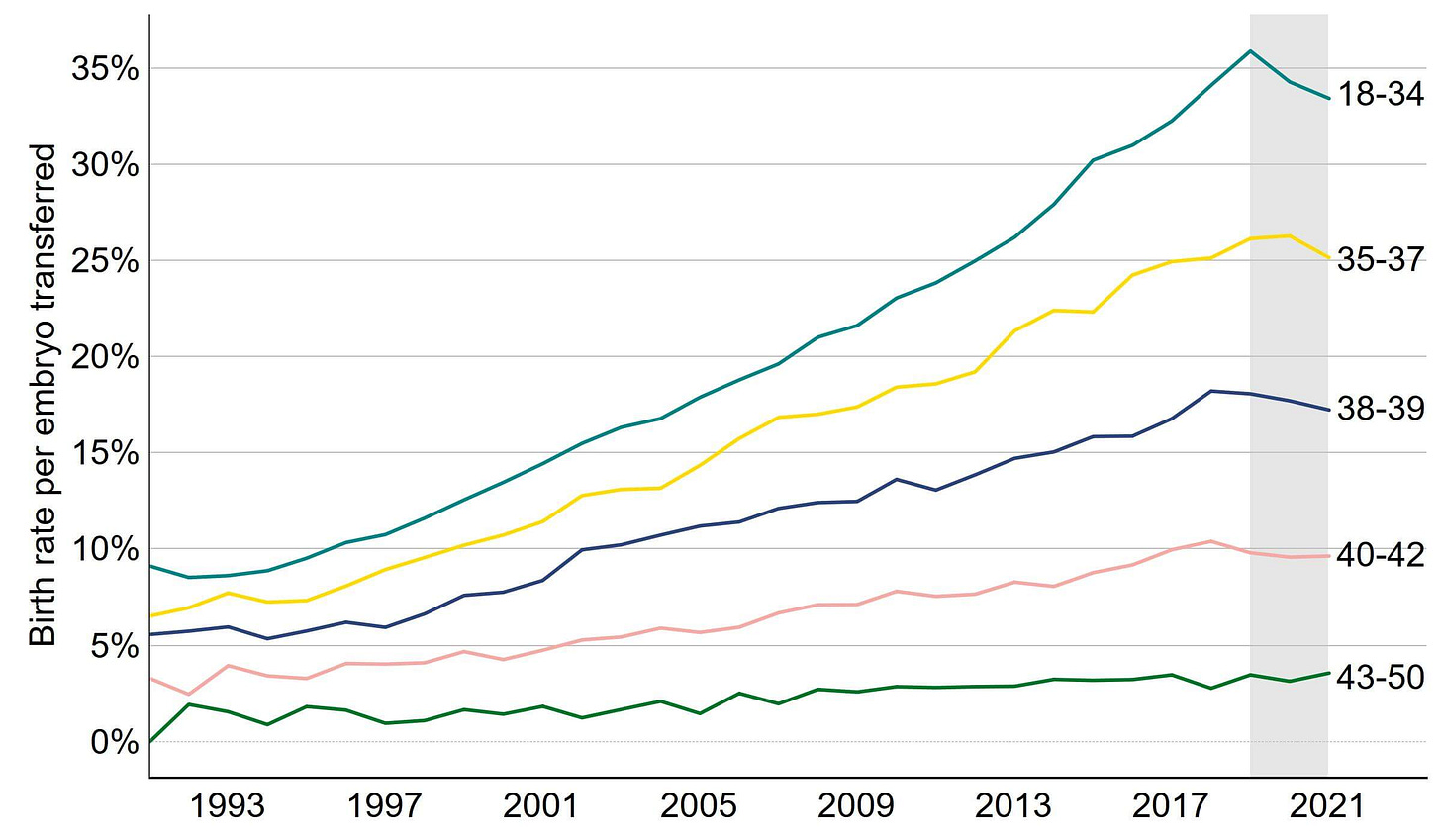

In the UK, the birth rate per embryos transferred in IVF, particularly through fresh embryo transfers, witnessed an increase or remained steady across all age groups.

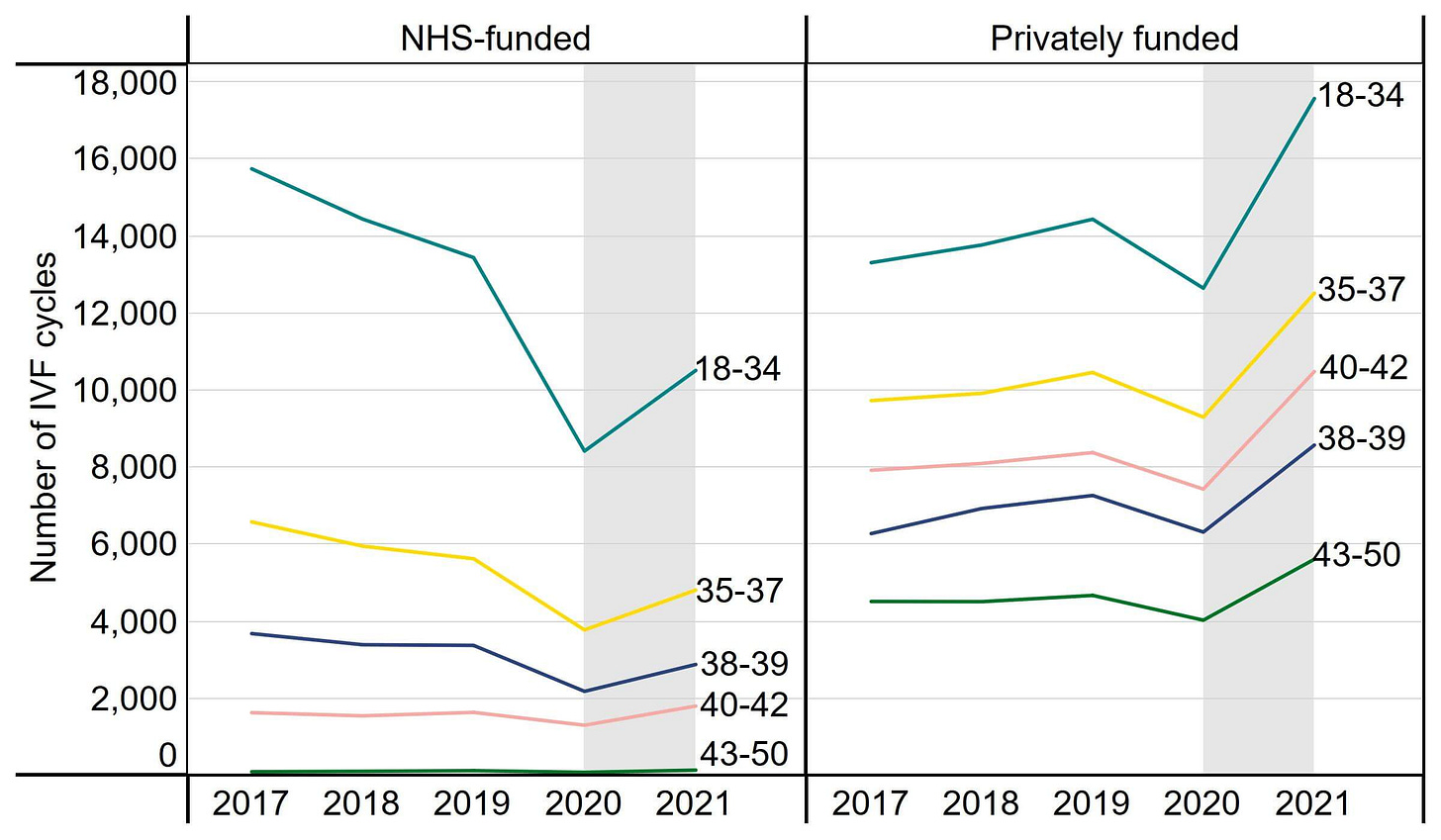

NHS vs Privately funded: NHS-funded IVF cycles experienced an increase from 2020, but they are still below the levels seen before the pandemic. (UK)

IVF has been a well-established method for quite some time, however, the chances of a live birth from an IVF cycle using a woman's own fresh eggs significantly diminish with age. For women over 42, the American Society of Reproductive Medicine (ASRM) states that there is only a 3.9% likelihood of a live birth resulting from such a cycle. The probability decreases further for women over 44, with the US National Center for Chronic Disease Prevention and Health Promotion indicating a mere 1.8% chance of a live birth under the same circumstances.

Investment

Fertility technology startups find themselves amidst a funding frenzy, as the demand for fertility services continues to soar, with a staggering investment of over $800 million in 2022.

Over the past decade, venture funding for fertility-focused technology has witnessed a steady rise, reaching an impressive $854.5 million in 2022, as reported by PitchBook. This represents a significant increase compared to $305.7 million in 2017 and a mere $134 million in 2012.

In a broader context, startups dedicated to women's health amassed a remarkable $1.4 billion in funding during 2021, indicating an impressive 80% surge from the $773 million raised in 2020, as reported by Rock Health.

Digital Solutions

Kindbody (US), a technology-driven fertility clinic network and family-building benefits provider, has become one of the most well-funded fertility companies. Serving 112 leading employers, covering 2.4 million lives, it raised $100 million in funding from Perceptive Advisors. With a total funding of over $290 million and a valuation of $1.8 billion, Kindbody stands as the largest women-owned fertility company for employers and consumers.

Founded in 2018 to address the fragmented, inequitable, expensive, and inaccessible fertility healthcare in the U.S., Kindbody offers comprehensive virtual and in-person care through its own fertility clinics, saving employers 25%-30% by direct contracting.

Maven Clinic (US) achieved unicorn status after securing $90 million in financing, pioneering maternal and family health startups.

Progyny (US), the first publicly listed fertility benefits company, reported $501 million in revenue in 2021, representing a 45% increase from the previous year. Their data-driven platform aims for improved outcomes and cost savings for self-insured employers.

Carrot Fertility (US), founded in 2016, has raised $115 million in VC funding. Partnering with companies, it offers comprehensive fertility benefits, including egg and sperm freezing, IVF, adoption, surrogacy, and additional menopause and low testosterone services.

Gaia (UK), using predictive technology, offers the world's first-ever insurance product for IVF, providing innovative solutions in the field of fertility coverage.

Although many of the companies in the sector focus on women and their reproductive systems, half of all infertility cases involve problems related to sperm.

FemTech Startups are on the Rise

As we move forward, my forthcoming post will delve into the most promising fertility startups that deserve attention.

Looking ahead, investing in enhanced policies and public financing holds the potential to bring about transformative changes, making fertility treatments more accessible and safeguarding vulnerable households from the financial burdens associated with such expenses.

+ fertility is good,

Martin

P.S. I used some of the following sources to obtain the data for this article:

(1) WHO (2) ReportLinker (3) HFEA-UK (4) Axios