2023/Changing Priorities in Digital Health Funding

Emphasis on Disease Treatment, Nonclinical Workflow, and Value-Based Care

As we roll into Q4 of 2023, the venture market is taking on a fresh outlook after a dynamic start to the year in Q1-Q3. The digital health sector has seen some shifts, with funding and deal volume seeing noticeable reductions. However, it's not all gloom and doom. Investors are showing their support for startups venturing into novel treatment approaches and addressing nonclinical workflow challenges. Despite a few high-profile IPO flops this year, the overall performance of the digital health sector in the public market has stabilized.

So, what's the verdict?

Digital health might be getting smaller, but it's definitely packing a punch.

In this article, we'll explore the implications of this evolving landscape as investment priorities pivot towards:

1. Disease treatment,

2. Nonclinical workflow, and

3. Value-based care.

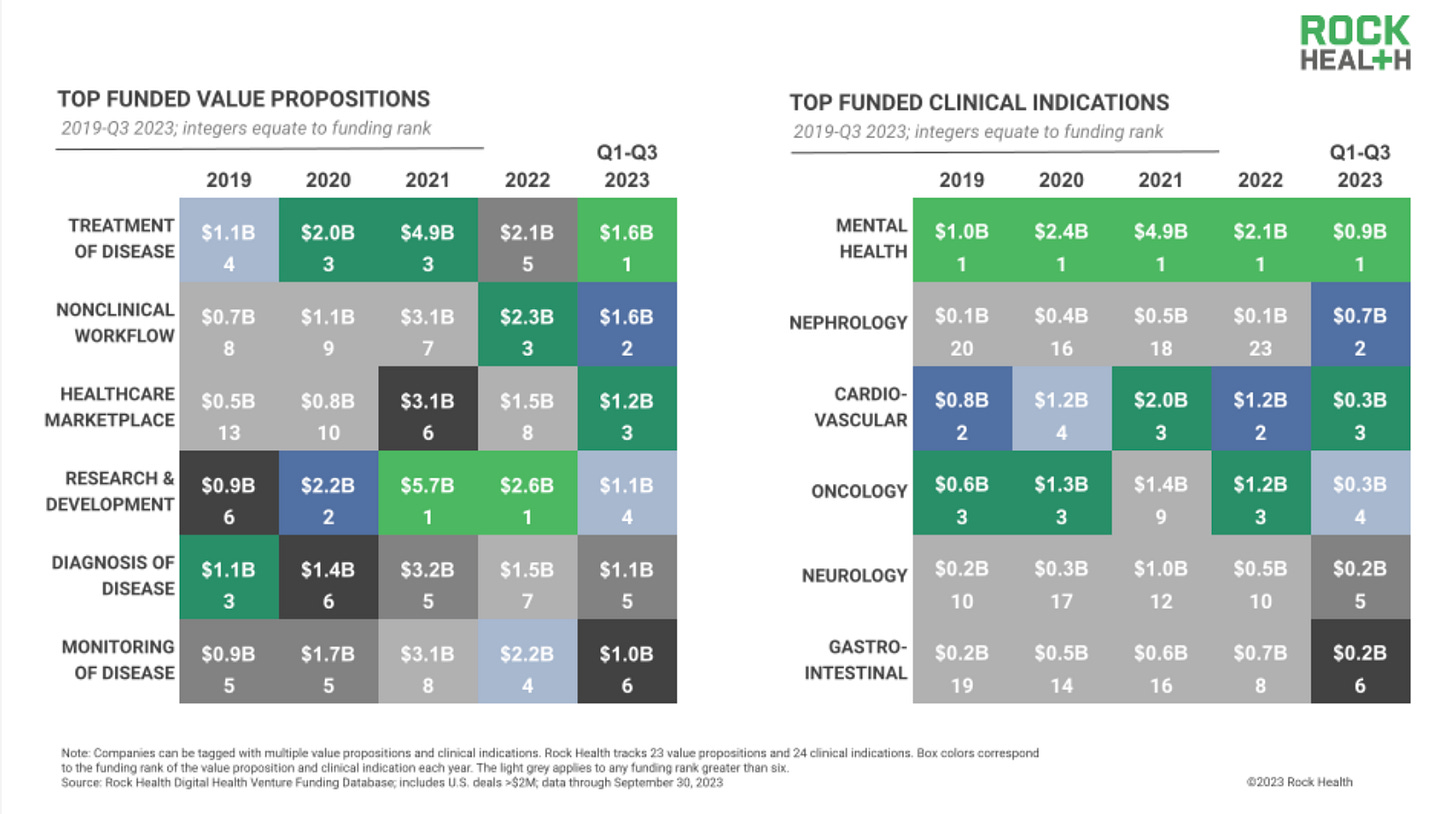

Despite seeing fewer deals and less funding in 2023 so far, by Q3, some clear trends had emerged in the digital health investment landscape. Notably, there was a shift away from the previous focus on on-demand healthcare and life science R&D catalysts, which had been the top investment areas in 2021 and 2022.

Instead, investors started directing their funds toward digital health products and services that support disease treatment, streamline nonclinical processes, and manage complex conditions like kidney disease.

1. Disease Treatment

The funding leaderboard for digital health value propositions was topped by disease treatment, with a total of $1.64 billion raised from Q1 to Q3 in 2023. Some of this funding found its way to comprehensive virtual clinics like Vivante Health, backed by Rock Health, which secured $31 million. Vivante Health offers a one-stop solution, including telemedicine, nutrition coaching, and self-guided modules for digestive health.

2. Nonclinical workflow

Nonclinical workflow solutions claimed the second spot, gathering $1.59 billion in funding during the same period. Players in this field are tackling a wide range of tasks, from managing durable medical equipment, as seen with Synapse Health, which secured $25 million, to handling revenue cycle management, like Collectly, which raised $29 million, and even improving patient scheduling and communication, as exemplified by Keona Health, which received $7 million in funding.

3. Value-based care

Mental health continued to be a top-funded area among digital health startups, with a total of $0.9 billion deployed year-to-date. Interestingly, nephrology gained unexpected attention, raising $0.7 billion in 2023, a significant increase from the mere $54 million raised in the entire previous year. Investments in both these specialties increasingly centered on digital health startups that facilitated value-based care (VBC) arrangements or took on risks themselves. For instance, Better Life Partners, with $26.5 million in funding, has established itself as a leader in value-based care for substance use disorder, mental health, and harm reduction. On the other hand, Healthmap Solutions, backed by $100 million, caters to payers and providers seeking VBC solutions for chronic kidney disease.

As policy initiatives related to VBC gain momentum and major healthcare enterprises delve deeper into VBC models, VBC enablement is becoming a crucial aspect of startups' business strategies and driving collaborations with large enterprises. This shift is particularly noticeable in high-cost therapeutic areas like mental health, kidney care, cardiovascular care, and oncology, which happen to be the top four clinical areas receiving funding in our Q3 2023 analysis.

If a startup can successfully reduce the overall cost of care in a risk-based arrangement, it can provide immense value to payers and other customer organizations. Traditionally, most digital health investors have focused on VBC enablement for primary care. However, there is now a growing interest in exploring the untapped potential of VBC enablement for specialty care needs.

+ Digital Health Funding is Good

Martin

P.S. I used some of the following sources to obtain the data for this article:

(1) Rockhealth.com

Very insightful!