25 Top VC Funds Investing In Health-Tech in Europe (Seed to Series A)

Europe has become a vibrant hub for health technology

Subscribe: If this newsletter was forwarded to you, subscribe here.

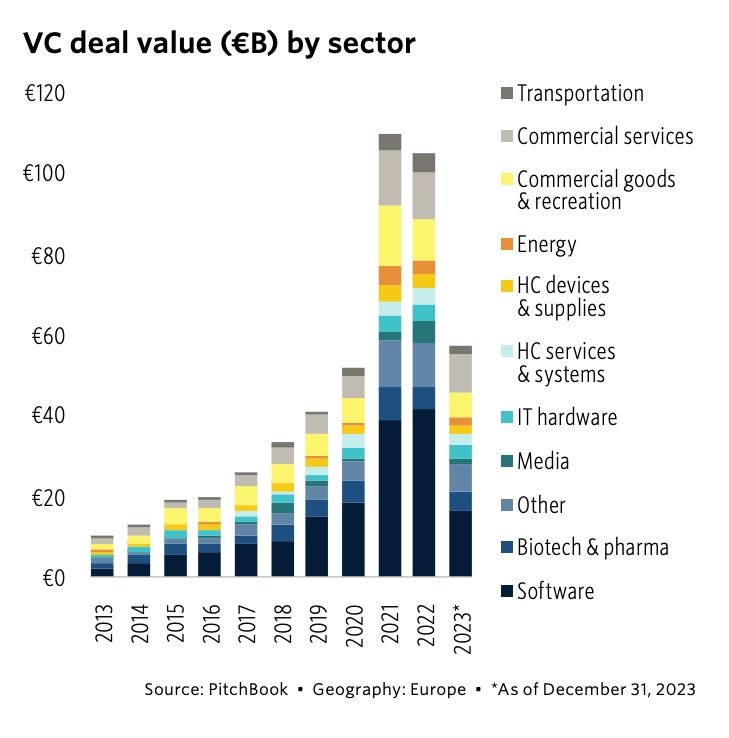

The digital health sector has seen some shifts, with funding and deal volume seeing noticeable reductions in 2023. However, it's not all gloom and doom. Investors are showing their support for startups venturing into novel treatment approaches and addressing nonclinical workflow challenges. Despite a few high-profile IPO flops, the overall performance of the digital health sector in the public market has stabilized.

In 2023, biotech & pharma emerged as the winner of sector trends.

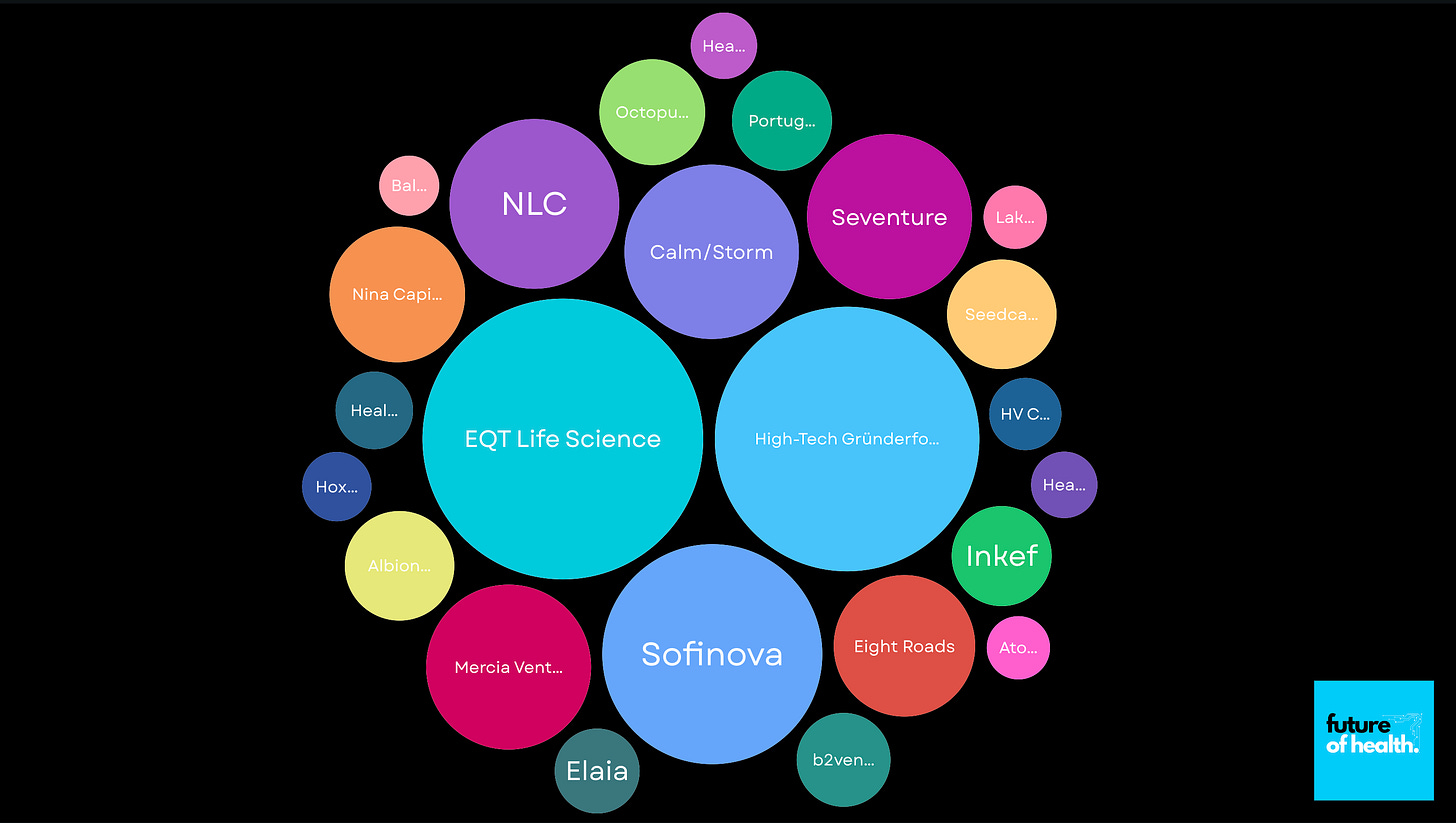

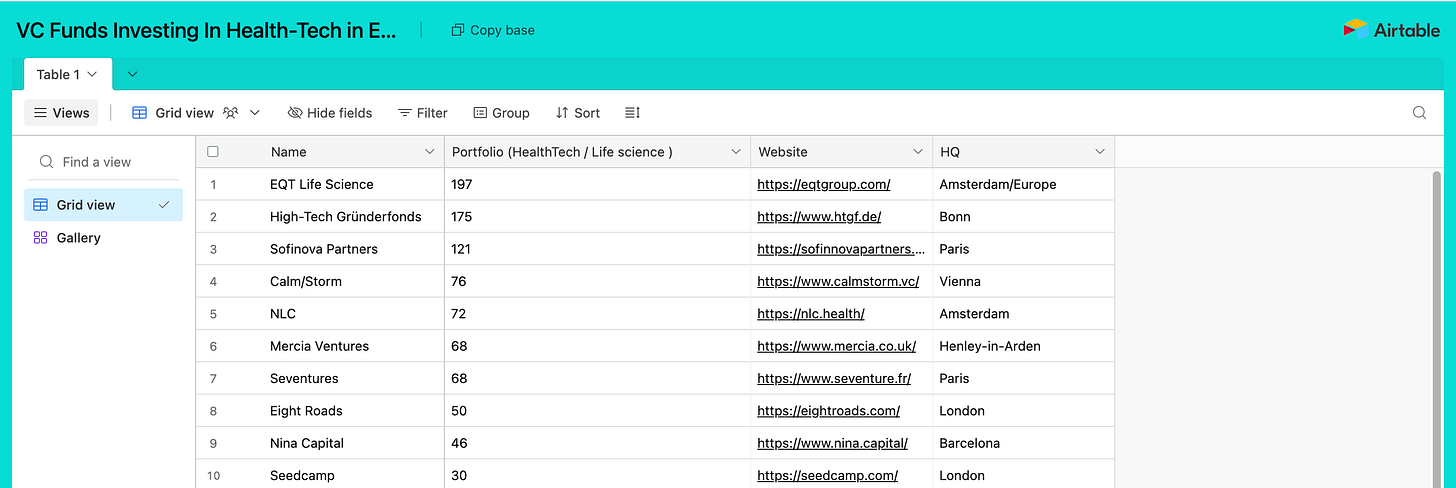

Let's explore which investors played a pivotal role in shaping early-stage (Seed - Series A) health-tech deals in Europe in 2023:

1- EQT Life Science & EQT Group

HQ: Amsterdam

Health-tech / Life Science deals: 197

EQT is a global investment firm with an extensive international footprint, engages in investments across various projects, companies, stages, and verticals. Operating under the umbrella of EQT, EQT Life Science serves as its Europe-based arm, specializing in direct investments in innovative life sciences and healthcare companies. Having successfully raised over €3 billion, EQT Life Science has invested in more than 190 private companies. The dedicated team comprises highly experienced investment professionals with diverse backgrounds in medicine, science, and industry.

2- High-Tech Gründerfonds

HQ: Bonn

Health-tech / Life Science deals: 175

HTGF is a German seed investor focusing on tech start-ups with substantial growth potential. HTGF currently oversees approximately 1.4 billion euros through its fourth fund. More than just a financial investment, the fund provides invaluable guidance, aids in scaling businesses by fostering connections with customers, enhancing sales efforts, and delivering industry-specific insights. Additionally, they contribute expertise in leadership, management, and operational excellence, aiming to drive sustained success for their portfolio companies.

3- Sofinnova Partners

HQ: Paris

Health-tech / Life Science deals: 121

Sofinnova Partners is a leading venture capital firm specializing in life sciences investments, focusing on healthcare and sustainability. Operating from offices in London, Milan, and Paris, they employ a comprehensive approach across six investment strategies to support companies at various growth stages:

Sofinnova Capital Strategy: Serves as a founding and lead investor in early-stage biopharma and medtech start-ups.

MD Start Strategy: Acts as Sofinnova's in-house medtech accelerator.

Sofinnova Crossover Strategy: Supports innovative later-stage biotech and medtech companies, facilitating their journey to full potential.

Industrial Biotech Strategy: Seeks early-stage investments with a positive impact on sustainability in chemicals, agriculture, food, and materials.

Sofinnova Digital Medicine Strategy: Backs early-stage startups at the intersection of biology, data, and computation.

Sofinnova Telethon Strategy: Focuses on early-stage projects to showcase the best Italian science on the global stage.

Take a look at the full list of VC funds by following this link 👉 bit.ly/490sAZ7

4- Calm/Storm

HQ: Vienna

Health-tech / Life Science deals: 76

Ranked among the most engaged health investors in Europe, Calm/Storm, an Austrian venture capital firm, maintains its commitment to supporting innovative startups. With a particular focus on femtech, tabootech, and female founders, the firm continues to invest in ventures like Fertifa, a reproductive healthcare platform, Doctorly, a startup specializing in medical practice management software, and inne, a hormone tracking startup.

5- NLC

HQ: Amsterdam

Health-tech / Life Science deals: 72

Established in Amsterdam in 2015, NLC is a healthtech venture builder with four funds. The most recent one, the NLC Health Impact Fund, achieved a first close of €20m in June 2023.

6- Mercia Ventures

HQ: Henley in Arden

Health-tech / Life Science deals: 68

Mercia stands out as one of the United Kingdom's most prolific venture capital investors, providing venture capital investment opportunities of up to £10 million.

7- Seventure

HQ: Paris

Health-tech / Life Science deals: 68

Seventure, an active French venture capital fund, operates across digital technologies, life sciences, nutrition, and the blue economy, with offices in Switzerland, France, and the UK. The life science arm, established in 2001, focuses on pioneering biotechnological investments, particularly in agro-food companies promoting health benefits. Presently, their primary emphasis is on microbiome applications, identifying it as a key area for future development with substantial opportunities for new medicines. Seventure supports companies in various stages, ranging from seed ventures to late-stage enterprises, investing €1-10 million per financing round and up to €20 million per company across multiple rounds.

8- Eight Roads

HQ: London

Health-tech / Life Science deals: 50

Eight Roads Ventures is a global venture capital firm managing $11bn of assets across offices in the UK, China, India, Japan, and the US. The Europe & Israel Ventures team focuses on scaling up technology companies in sectors like technology, fintech, and healthcare, helping them achieve global expansion.

9- Nina Capital

HQ: Barcelona

Health-tech / Life Science deals: 46

Nina Capital, headquartered in Barcelona, operates across Europe and extending their investments to the United States, Canada, and Israel. Nina Capital primarily targets preseed and seed-stage investments, occasionally participating in series A rounds and providing potential follow-on support up to Series A. They offer investment ticket sizes ranging from €150.000 to €1M

10- Seedcamp

HQ: London

Health-tech / Life Science deals: 30

Seedcamp, headquartered in London, is an early-stage venture capital firm with a global investment focus. Seedcamp's investment spans various sectors, including software, hardware, marketplaces, fintech, healthtech, and AI/ML. Their extensive network of investors, mentors, and experts provides valuable support to portfolio companies. As a first-cheque investor, they typically invest between $350.000 to $1M in founders at any stage of product development.

Venture deal value in 2023 landed at €57.1 billion, 45.6% lower YoY.

VC deal activity in Europe as of December 31, 2023. Source: PitchBook

Suggestion? Critiques? Send your feedback in this link or reply to this e-mail. 🙁 😐 😍

Explore other topics that might pique your interest 💡📍 Why do venture capitalists aim to invest billions in hospital ownership?

The conventional Private Equity strategy involves identifying hospitals catering to affluent patients, cutting costs, boosting earnings, and selling at a higher value after a few years. However, General Catalyst sees more potential in adopting a long-term vision. 👉 Click here to read the full article.

📍Rethinking Employee Healthcare and Benefits in the 21st Century.

Employers are facing increasing pressure to proactively address societal issues, including women's health, health equity, and mental well-being.

👉 Click here to read the full article.

The contents of this newsletter have the potential to influence those around you. Feel free to share it with anyone you believe might find it interesting.

+ Health-Tech innovation is good

Martin

P.S. I used some of the following sources to obtain the data for this article:

(1) Crunchbase (2) Seedtable (3) Dealroom (4) PitchBook

P.S. (1) The ranking is based on the total number of deals within the portfolio of each VC fund.

*Note: If I'm missing any VC funds and you think I should add them to the list, please DM me here.