Digital Health: Top 5 Investment Takeaways for 2023

Back To Reality: A New Market Cycle

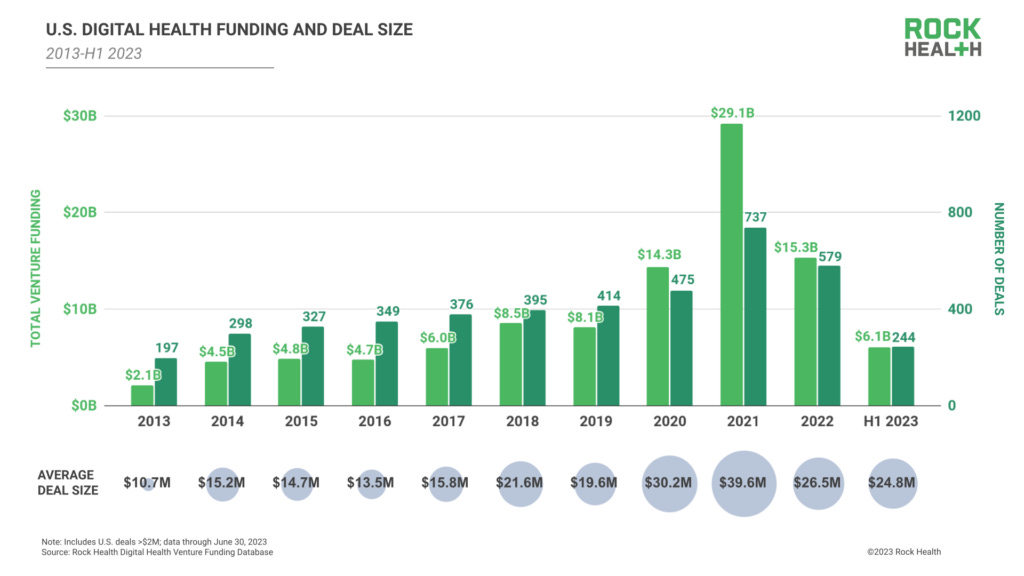

The digital health funding landscape is undergoing a significant transformation, presenting challenges for startups seeking investment. In the first half of 2023, the industry experienced a notable shift with fewer deals and smaller check sizes, according to Rock Health. Although these figures pertain specifically to the US, a striking disparity emerges when comparing this year's deal count to the averages of the past decade.

Funding Trends: In H1 2023, U.S. digital health startups raised $6.1 billion across 244 deals, with an average deal size of $24.8 million. However, compared to Q1 2023, Q2 saw a decline in funding, with only $2.5 billion raised across 113 deals. This trend indicates a smaller funding year compared to previous years.

Decrease in Investor Participation: The number of investors participating in digital health deals has also decreased. In H1 2023, 555 investors participated, down from 775 in H1 2022 and 832 in H1 2021. This suggests that generalist and crossover investors are moving away from the sector, leaving a smaller group of focused digital health investors.

Challenges for Startups: Many digital health startups are facing challenges in the new funding environment. To avoid down rounds and maintain valuations, some startups are raising capital without publicly labeling the rounds. In H1 2023, 41% of funding deals were unlabeled, indicating a tactic to protect valuations. However, this approach is seen as a short-term strategy.

Mega Deals and Investor Confidence: Despite the overall decline in funding, H1 2023 witnessed several mega deals, with 12 deals comprising 37% of total funding. Investors are making big bets on companies they see as promising, especially in areas such as value-based care, non-clinical workflow, and at-home care. Some investors are also incubating startups to increase their chances of success.

Many of H1 2023’s mega deals clustered around one of three digital health transformation areas: (1) value-based care enablement (Strive Health; $166M, Arcadia; $125M, Vytalize Health; $100M); (2) non-clinical workflow and practice management (Shiftkey; $300M, ShiftMed; $200M, MedShift; $108M); and (3) at-home care (Author Health; $115M, Monogram Health; $375M).

Acquisition, Sunset, and Asset Sell-offs: Due to the challenging funding landscape and a frozen IPO market, startups are considering acquisition offers. However, the number of acquisitions has decreased compared to previous years. Some startups have chosen to sunset their businesses, while others have had their assets acquired and relaunched by other companies. H1 2023 averaged just over 12 acquisitions of digital health startups each month, down from more than 15 M&A deals per month in 2022 and 14 M&A deals per month over the past five years.

For companies that aren’t offered or interested in a purchase bid, the time may come to sell or sunset the business. Beyond the highly publicized bankruptcy of Pear Therapeutics, this half saw digital health startups including SimpleHealth, The Pill Club (also known for a select time as Favor), Hurdle, and Quil Health close their doors.

Other digital health startups are gaining second lives through asset acquisitions and relaunches. Pear’s prescription digital therapeutics (PDT) assets, for example, were distributed to four buyers. More straightforward asset transfers include Twentyeight Health’s acquisition of SimpleHealth customers in the reproductive care and sexual wellness space, Transcarent’s purchase of 98point6’s AI-powered virtual care platform and care business, and ThirtyMadison’s purchase of the assets of online birth control clinic, The Pill Club.

This reset offers an exciting opportunity for the digital health industry to gain fresh insights and adopt a more focused approach. Despite the challenges it may pose, these tough times can serve as a necessary market correction, aligning innovators and investors with more realistic expectations.

+ endurance is good,

Martin

P.S. I used some of the following sources to obtain the data for this article:

(1) Rock Health (2) Crunchbase