New Branding & 10 Health-Tech Trends To Watch In 2024

The future lies in health technology.

Hey there,

I'm thrilled to take a moment and share a slice of my journey with you through this newsletter. Back in June 2023, I kicked off The Endurance Revolution with a simple yet ambitious goal—to delve deep into the health tech and sport tech industry. Why? Because I've made a conscious decision that this is where I want to channel my time and energy for the next two decades.

The first iteration of The Endurance Revolution—the one you're currently reading—saw some decent numbers with 20 articles and almost 100 subscribers in just six months, marking it as the inaugural MVP - minimum viable product. Now, it's time for the next chapter.

In recent months, my focus has honed in mainly on health tech. Why? Because I hold a strong conviction that the future lies in health technology—a future in which we can enjoy extended lifespans and improved quality of life, leveraging a healthcare system that is not just efficient but also integrated and proactive.

So, here's the exciting news—I'm introducing the second phase of this newsletter. The next step? A brand new name and logo. Say goodbye to The Endurance Revolution and welcome "The Future of Health." I hope you find the new look as invigorating as I do! 😊 What can you expect in this revamped version? Well, get ready for M&A analyses of the health-tech industry, insightful charts brimming with relevant data, and exclusive interviews with entrepreneurs, operators, and investors primarily active in Europe.

Thank you for being part of this journey! I hope you continue to find joy in it.

Note: you should expect a full rebranding after this newsletter.

Now yes, diving into the Top 10 Health-Tech Trends of 2024

1. M&A on the Rise

In 2023, the digital health sector experienced a significant downturn in funding levels due to multiple factors. This decline was primarily attributed to higher interest rates, constraining venture capital firms' ability to raise funds. As a result, startups faced lower valuations and a frozen IPO market, leading to reduced available cash.

This financial strain pushed many startups towards consolidation efforts, anticipating potential mergers and acquisitions as a means of survival; Babylon Health was big news last year, with a very difficult 2023. Additionally, the industry's focus shifted towards assessing the effectiveness of solutions developed during the peak investment period, seeking insights into their impact on healthcare access and quality of care.

Looking ahead to 2024, the digital health landscape might see a gradual rebound in funding, especially in the latter half of the year. Notably, leading companies backed by venture capital are considering M&A as a strategic tool to incorporate smaller competitors, acquiring customers, expanding geographical presence, and enhancing their product offerings. This consolidation trend may signal a shift towards a more mature and diverse healthcare environment, potentially liberating resources from smaller, less impactful entities to support the growth of the next wave of healthcare entrepreneurs and scalable enterprises.

2. AI in Healthcare

Since ChatGPT's launch in late 2022, Generative AI has significantly impacted the landscape of AI in healthcare. As the technology continues to gain traction, focus now shifts towards developing the essential infrastructure to seamlessly integrate AI tools into healthcare systems. This includes establishing robust safety and compliance standards while ensuring transparency regarding the data used to train these AI products. Amid expectations of reduced hype and investment in 2024, attention remains centered on pivotal aspects. For AI builders, addressing algorithmic biases, ethical concerns, and enhancing transparency stands as crucial steps towards facilitating the integration of AI into practical clinical applications. Simultaneously, healthcare stakeholders, comprising providers, payers, and life sciences companies, are tasked with solidifying AI governance approaches. They must carefully weigh the trade-offs between platform-level integrations, like EMR plugins, versus specialized applications for specific functionalities to craft enduring AI strategies, with transparency notably gaining importance, particularly in tools aiding clinical decision-making and claims appraisals.

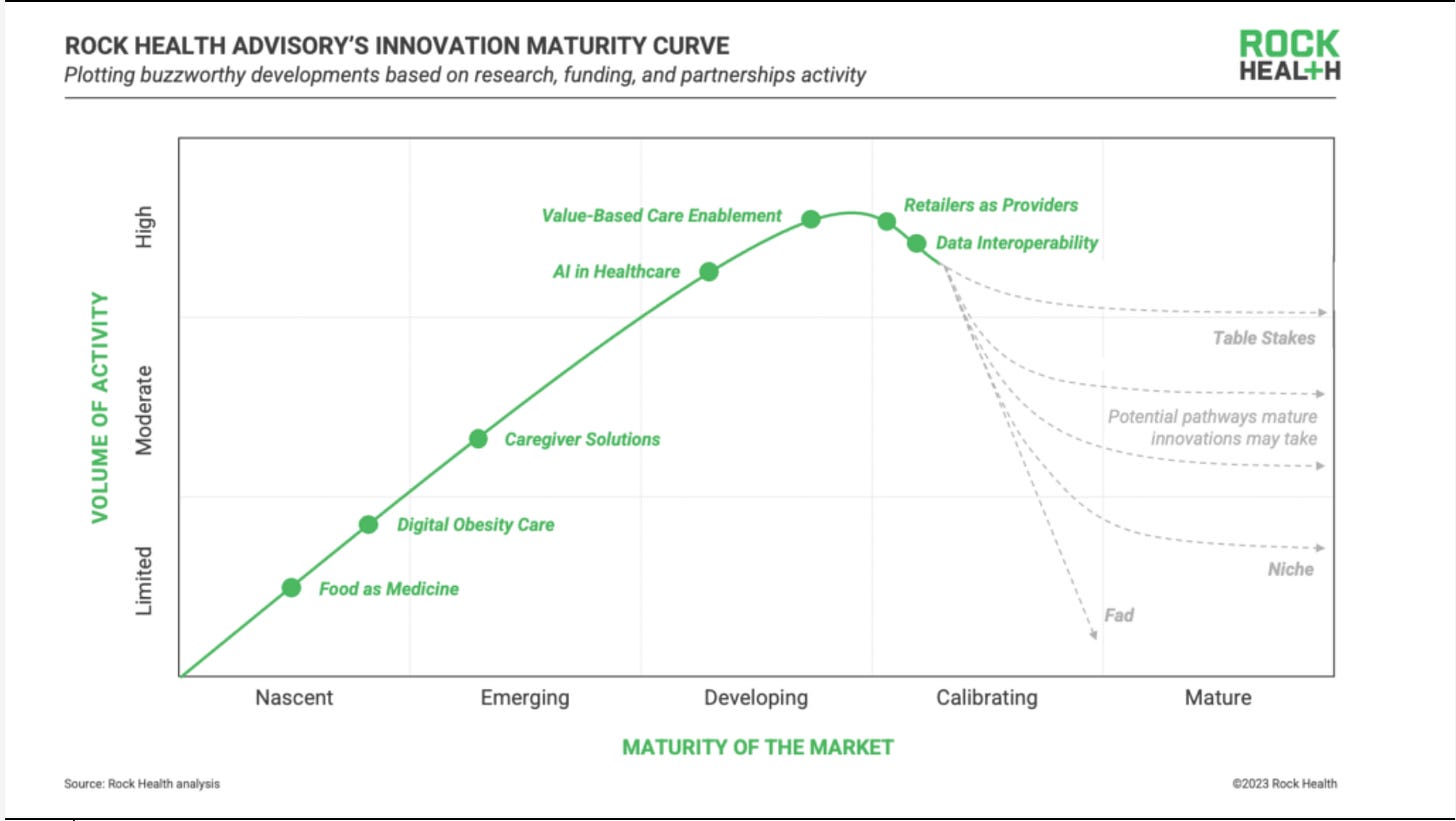

The Maturity Curve

In order to grasp the upcoming wave of innovations, it's essential to examine Rock Health's maturity curve. I particularly appreciate Rock Health's Maturity Curve for monitoring advancements in healthcare innovation. This analysis assesses and ranks developments based on three measurable indicators:

1. research publication volume reflecting early potential and industry interest,

2. venture funding indicating investor excitement and maturity, and

3. partnership activity serving as a proxy for commercial traction.

The maturity curve evaluates health tech innovations across five stages of maturity throughout their evolution:

Nascent: areas are gaining early awareness in the market

Emerging: areas are increasing in activity, including from large-scale players

Developing: areas graner major funding and market buzz, but are not yet scaled

Calibrating: areas are currently scaling and settling into longer term trajectories.

Mature: mature innovations may take different pathways (eg: Niche, Fad, etc)

Let's take a look to what we should be following closely in the year ahead.

Food as medicine: (maturity score, Nascent). In 2024, retailers such as Instacart and Kroger are expected to intensify investments in medical nutrition innovations, aligning with the expanding legislative and reimbursement landscape. Health plans are anticipated to lead in adopting food-as-medicine programs as wraparound services, with other payers likely to follow suit. Innovative healthcare providers and startups, especially in areas like obesity care, can leverage food-as-medicine initiatives to differentiate their care delivery models through partnerships with emerging startups focused on this approach.

Digital obesity care: (maturity score, Nascent). In the realm of GLP-1 medications, challenges related to supply chain, cost, and accessibility will persist, influencing their market journey. Payers are expected to advocate for precise triage and treatment programs, emphasizing the integration of drug therapies within holistic care models, while emerging obesity care models aim to stand out through enhanced personalization and addressing the root causes of disease.

Caregiver solutions: (maturity score, Emerging). In 2024, the caregiver-focused market is anticipated to expand amid challenging economic conditions, driven by increasing challenges and negative health impacts faced by caregivers. Employers and consumers may invest in administrative caregiver solutions, with successful B2B2C options demonstrating the ability to reduce absenteeism, boost engagement, and enhance caregiver-employee well-being. Life sciences companies and providers may also explore caregiver-oriented solutions, particularly in clinical areas with high caregiver influence, while startups are expected to offer diverse solutions addressing various caregiving needs.

AI in healthcare: (maturity score, Developing). Already explained above.

Value-based care enablement: (maturity score, Developing). In 2024, the success of value-based care enablement hinges on outcomes demonstrated by major national payers and managed service organizations. Consolidation within major provider systems may drive the platformization of value-based care enablement solutions, addressing multiple needs in a unified approach. While providers aim to expand value-based contracting in clinical areas with established care pathways, the complexity of developing and executing these contracts remains a central challenge, prompting reliance on startups focused on enablement to navigate this complexity.

Retailers as providers: (maturity score, Calibrating). Retailers are forging partnerships with digital health companies, indicating the maturity of the sector in delivering care beyond traditional clinics.

In 2024, the retail sector is expected to broaden its care models, venturing into higher-cost clinical areas like chronic diseases. Focus will be on minimizing friction during handoffs between retail and traditional providers, meeting home-based demand through omnichannel services, and creating partnership opportunities for startups and providers in the pursuit of convenient care expansion.

Data interoperability: (maturity score, Calibrating). In 2024, the significance of access to accurate and reliable healthcare data will rise, with interoperability solutions prioritizing precision, depth, security, and usability gaining distinction. Advanced data infrastructure adoption among incumbents emphasizes the need for disruptive interoperability solutions, expected to include built-in analytics and insights capabilities. Payers and providers are urged to assess and upgrade their internal data management strategies to support advanced analytics in the evolving landscape.

10. Bonus Track: Psychedelics

I am personally very bullish on the Psychedelics market. Psychedelics, historically used in religious and ceremonial settings, are gaining increased interest for their potential in treating various physical and mental conditions. The evolving media narrative and promising research contribute to growing acceptance of psychedelics as medicine. Early results suggest that psychedelic therapy, by creating new neural pathways, could reshape how we approach mental illness and other conditions, with potential FDA approvals in the coming years paving the way for mainstream acceptance.

Psychedelics showed promise in treating mental illness as early as the 1950s, but research was essentially shut down in the 1960s. In 1970, the Controlled Substances Act classified psychedelics as Schedule 1 drugs, which have “no currently accepted medical use and a high potential for abuse.” Now, a second wave of psychedelic research is underway, including a number of promising academic studies related to treating anxiety and depression. As a result, the use of psychedelics for medical purposes has renewed credibility and there is currently significant clinical trial activity for a number of psychedelic compounds that have a credible chance of achieving approval from FDA.

I am closely following two companies in this sector:

- Atai Life Sciences: Atai has raised a total of $522.1M in funding over 11 rounds. Their latest funding was raised on Aug 15, 2022 from a Post-IPO Debt round. Peter Thiel is one of the main investors.

- Compass Pathways: Compass has raised a total of $271.2M in funding over 6 rounds. Their latest funding was raised on Aug 16, 2023 from a Post-IPO Equity round.

In 2024, the psychedelics market is poised for a transformative year marked by specific advancements. Anticipate a surge in FDA approvals for psychedelic therapies, signifying a critical milestone in mainstream acceptance. Ongoing research and clinical trials will likely yield breakthroughs, especially with substances like psilocybin and MDMA, showcasing their potential to revolutionize mental health treatment. The industry will see continued efforts to destigmatize psychedelics, fostering increased regulatory acceptance and accessibility. Innovative treatment modalities integrating psychedelics into mainstream mental health care are expected to emerge, providing clinicians with additional tools to address conditions such as depression, PTSD, and anxiety. Overall, 2024 promises to be a pivotal year, driving the psychedelics market toward wider recognition and application in therapeutic settings.

As we look ahead to 2024, the unfolding landscape promises interesting dynamics, marked by a gradual resurgence in funding and heightened M&A activity within the health tech sector. It's imperative for the market to recalibrate in order to sustain its trajectory towards maturity and continued growth.

Wishing you a successful and a healthy year ahead!

The contents of this newsletter have the potential to influence those around you. Feel free to share it with anyone you believe might find it interesting.

+ Health-Tech Innovation is good

Martin

P.S. I used some of the following sources to obtain the data for this article:

(1) Philips (2) Crunchbase (3) Global Data (4) Rock Health (5) Sifted

Uow! The new logo is super nice. Can’t wait to see the full rebranding.