Subscribe: If this newsletter was forwarded to you, subscribe here.

I am obsessed with this question: How can we stop diseases before they happen?

This led me to search for the different Genetic Tests available on Google, where, I discovered more than 30 options.

The fascination with uncovering one's genetic ancestry or gaining insights into personal health risks through Genetic Testing has become increasingly popular; and direct-to-consumer (DTC) Genetic Testing is very likely to be the entry point into most genomics, as Genetic Testing would be a prerequisite for any further treatment or manipulation in the future.

An example of this is the exclusive partnership established between GSK and 23andMe in 2018. Their focus is on developing new medicines and potential cures, using human genetics as the cornerstone of their research. This partnership garnered significant attention in the industry, signaling the potential future direction it might take.

The Power of Education and Awareness

The MIT Technology Review reports that more than 26 million people in the U.S. have already tried DNA tests. People are getting more curious about their ancestry and genes, thanks to lots of ads on the internet and social media. Big companies like 23andMe and Ancestry spend a lot of money advertising genetic tests directly to consumers to let them know about the benefits.

Furthermore, companies and government agencies are also working to make these tests more common in healthcare, which could help save money on medical bills. This is all helping the market for Genetic Testing grow.

24% Up

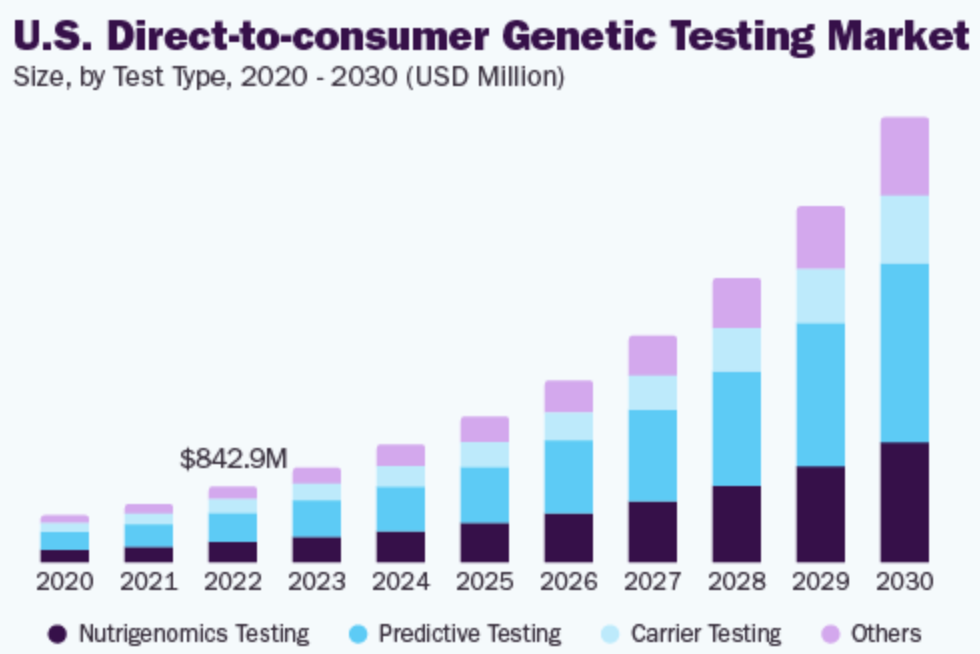

The global market for at-home Genetic Testing reached $1.93 billion in 2023 and is expected to continue growing by 24.4% each year from 2024 to 2030, reaching $8.8 billion. Online platforms were the most popular way to purchase these tests, making up 64.7% of sales in 2023.

Europe Takes the Lead

Europe is predicted to see the quickest growth in the coming years. This growth is because more people are facing genetic conditions, and the technology for Genetic Testing keeps getting better. People are also becoming more aware of and open to personalized treatment options. Plus, government policies that support reimbursement and other helpful efforts have helped the market grow.

Big companies are always working on new technologies to meet the demand for early diagnosis. For example, in January 2023, Unilabs partnered with Ambry Genetics to improve Genetic Testing services in Europe, Latin America, and the Middle East.

BUT, in healthcare, when it comes to security, keeping your data in the cloud doesn’t mean you can keep your head in the clouds.

DNA Security

Worries about privacy and security with genetic data could hurt the market's growth in the future.

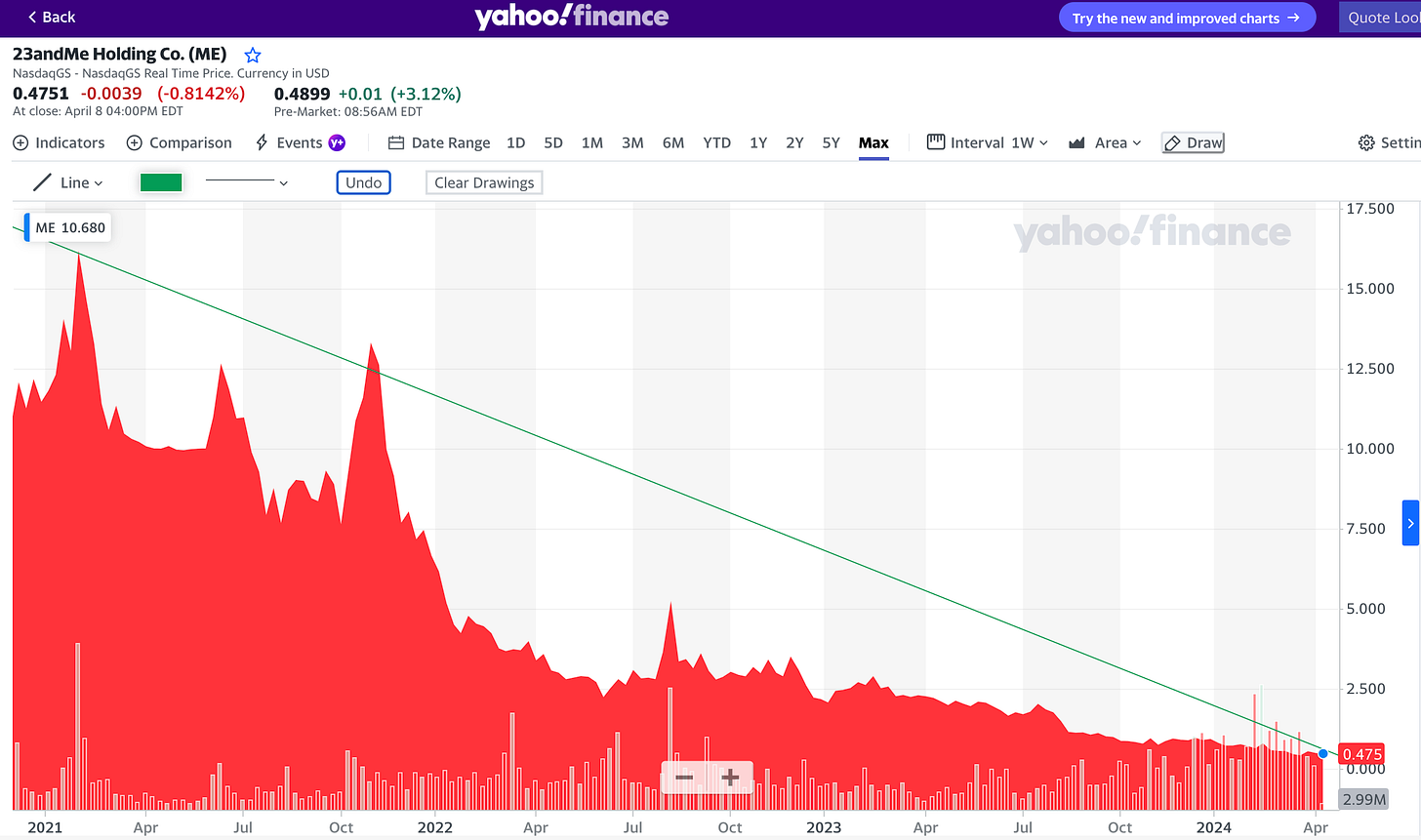

23andMe is facing financial trouble and its stock value has dropped significantly. What's the reason? The company has been criticized for security breaches affecting 6.9 million users. Additionally, it's finding it hard to keep customers interested in its products after they've used the DNA kit just once.

Shares of 23andMe are currently trading at around $0.475. In November, the company was told it broke Nasdaq rules, which say a company's stock price should be above $1. So, they've got about three months (180 days) to boost the price, or they could get kicked off the Nasdaq.

Key Players and Innovations

The market is moderately fragmented, with plenty of medium and big companies making most of the revenue. Let's explore further:

New Players

Nucleus Genomics

HQ: New York, United States

Investment: $17,5M

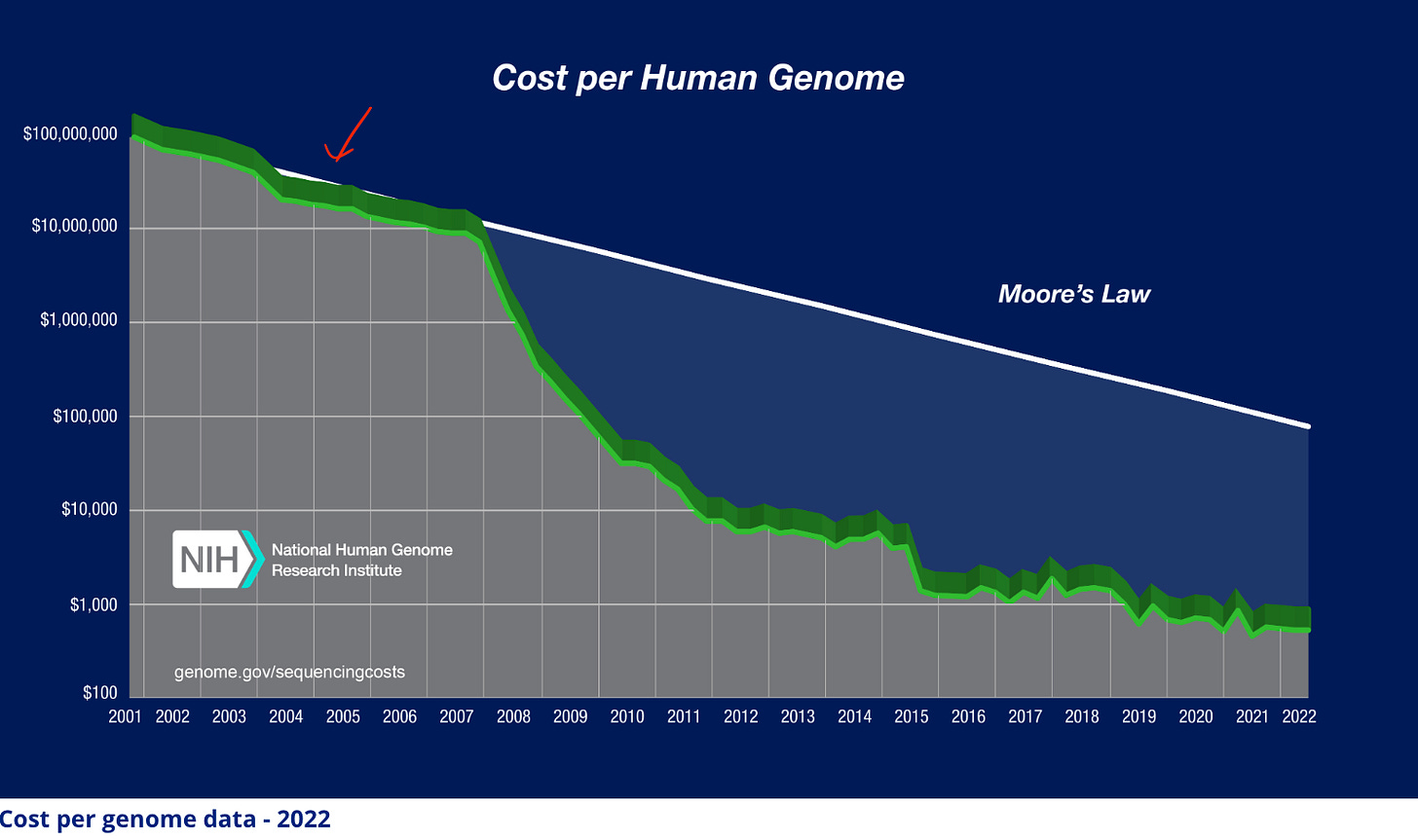

Product: Nucleus's health app uses whole-genome sequencing (WGS) to find risks for common health problems like heart disease, cancer, and rare genetic disorders. This approach became affordable thanks to dropping sequencing costs in the last 20 years. In 2022, Nucleus got $17,5 million in funding from Alexis Ohanian's Seven Seven Six and Peter Thiel's Founders Fund.

Advancements in technology may eventually lead to the integration of genetic and glycomic analyses for a more comprehensive understanding of biological processes, and this is where GlycanAge plays.

GlycanAge

HQ: Newcastle upon Tyne, United Kingdom

Investment: $4,7M

Product: The startup's technology aims to reveal users' biological age, which reflects how much their bodies have truly aged compared to their chronological age. Users receive a finger prick test kit at home, allowing GlycanAge scientists to analyze biomarkers indicating damage from lifestyle and environment, estimating their biological age. Additionally, users receive personalized consultations with specialists who offer tailored advice on slowing down aging.

Note: GlycanAge doesn’t analyse DNA, the company look at individuals glycobiology, an entirely different layer of molecular complexity that changes how our biology works beyond our genetics and epigenetics.

Older Players (most of these companies were built 20 years ago)

23andMe

HQ: California, United States

Investment: $1.1billion, Market Cap: $225M

Ancestry

HQ: Utah, United States

Investment: $33M. Acquired by Blackston in 2020 for $4.7B

Myriad Genetics Inc.

HQ: Utah, United States

Investment: $90M, Market Cap: $1.8 billion

Color Health, Inc.

HQ: California, United States

Investment: $482M

Looking Forward

Thanks to advancements in Next-Generation Sequencing (NGS), genome sequencing has become more accessible and affordable. Just twenty years ago, it cost over $20 million to sequence a human genome. Today, companies like Nucleus offer clinical-grade whole-genome tests for as low as $399. Genetic Testing has the potential to alleviate the growing burden of targeted diseases by minimizing the necessity for excessive screenings to detect life-threatening conditions.

+ TechBio is good

P.S. I used some of the following sources to obtain the data for this article:

(1) Grand View Research (2) Yahoo Finance (3) Unilabs (4) Fitt Insider (5) GSK (6) NIH

Other topics you might find interesting 💡📍 From Sick Care to Preventive Health

7 out of 10 deaths are caused by Chronic Diseases: heart disease, cancer, diabetes, AIDS or other conditions. 👉 Click here to read the full article.

📍61% of Digital Health Companies Pivot from B2C to B2B

B2B business models predominate digital health. 👉 Click here to read the full article.

The contents of this newsletter have the potential to influence those around you. Feel free to share it.