10 Acquisitions In 9 Years, Inside Unilever Prestige's M&A Strategy.

Deep dive into Unilever’s growth engine

I'm a huge fan of brands that aren't afraid to think outside the box and keep growing in today's speedy market. It's definitely a challenge, especially for giants like Unilever, with a huge team of 150,000 people worldwide and an annual revenue of €60 billion.

In 2014, Unilever embarked on a journey to tap into the fast-growing premium market, marking the genesis of the Unilever Prestige division. The premium market promised long-term growth, presenting a white space ripe for development and innovation.

Unilever’s Organisational Structure

Unilever Prestige's lineup of brands like Tatcha, Dermalogica and Paula’s Choice pulled in a whopping €1.2 billion in revenue in 2022; with ambitions to grow through acquisitions, innovation and digital commerce.

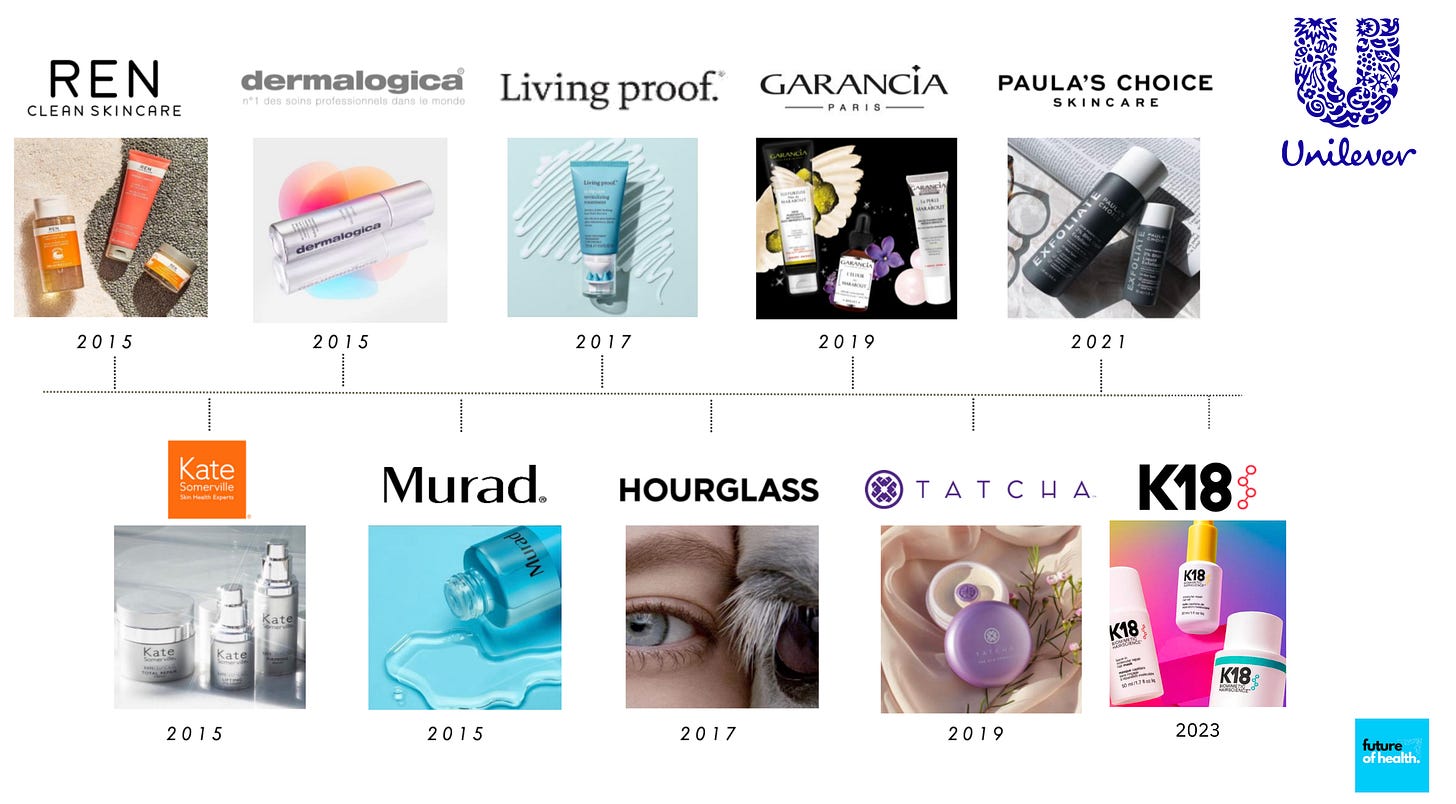

Let's take a look at the 10 acquisitions

1. K18 is the latest addition to the collection: Unilever made a big move in December 2023 by revealing plans to buy the high-end biotech haircare brand K18, a rapidly growing brand that blends beauty and biotechnology, offering a range of products to nourish and repair hair. K18 Hair has raised a total of $25 million and scored $75 million in retail sales in 2021, with a projected revenue of $150 million for 2022.

2. PAULA’S CHOICE was acquired by Unilever in 2021 for a reported $2 billion. TA Associates invested in the brand alongside Bertram Capital in 2016. Revenues were said to be around $70 million at the time and the business was valued at $275 million.

3. TATCHA was on track to do $100 million in net sales when it was acquired by Unilever in 2019 in a deal close to $500 million. Tatcha has raised a total of $19.8 million in funding from Castanea, Beechwood Capital and Finn Capital Partners.

4. GARANCIA The French derma-cosmetic brand joined the portfolio in 2019. The terms of the deal were not disclosed.

5. HOURGLASS generated net sales of approximately $70 million and was sold to Unilever for an estimated purchase price of $250-$300 million.

6. Living Proof has raised a total of $53 million in funding from Leerink Partners and Polaris Partners. The company was founded by venture capitalist and entrepreneur Jon Flint and MIT Professor Robert Langer. Unilever acquired the business in 2017.

7. Murad which had a turnover of $115 million in 2014, was incorporated into Unilever’s Prestige division in 2015.

8. Dermalogica sold in more than 80 countries, Dermalogica had a turnover of $240 million in 2014. The company was incorporated into Unilever’s Prestige division in 2015.

9. Kate, Unilever acquired the brand in 2015. Terms of the deal were not disclosed.

10. REN had sales of $62.6 million in 2013 and was incorporated into Unilever’s Prestige division in 2015.

What is the M&A strategy?:

The company aims to grow Unilever Prestige into a €3 billion enterprise by acquiring top-notch brands and focusing on innovation. Unilever Prestige brands can tap into Unilever's extensive research and development (R&D) resources. Take Hourglass' Red Lipstick, for instance, which was developed to eliminate carmine, a common red pigment ingredient derived from crushed female beetles used across the industry. This breakthrough took three years, 17 formulations, and 170 color experiments.

The thesis:

Target companies with revenues ranging from €50 to €300 million.

Concentrate on top-tier beauty, health, and wellness markets.

Pursue unique brands with strong growth potential.

Explore specialized areas within the market, from specific segments to distribution channels.

The winning model to grow to €3 billion in revenue by 2028

Unilever relies on five key pillars to achieve the ambitious target of reaching €3 billion in revenue:

Prioritizing the Brand-First Model: brand-centric approach, leaders in education

Emphasizing Speed, Agility, and Advocacy: cult brands with digital communities, pivot to eComm, continuous experimentation

Leading in Trend-Setting Innovation

Focusing on Social Impact and Purpose

Embracing Technology-First Beauty

Key trends and emerging technologies

What key trends is Vasiliki Petrou, Group CEO of Unilever Prestige, particularly excited about in the industry?

Rise of Clinical Brands and Doctor-led Products: Consumers are gravitating towards products backed by science and promising visible results, often led by doctors or experts.

Longevity Economy: This concept goes beyond just beauty and personal care, influencing various sectors including drug discovery and digital health. The intersection of longevity and AI, known as "generative health," is set to transform personalized health experiences. This means that in the future, technology could play a big role in tailoring health solutions to individuals, based on their unique health histories.

Neurotech Innovation: Neurotechnology is gaining prominence in beauty and personal care, offering solutions to combat stress and anxiety. It aims to enhance overall well-being by incorporating emotional and mental aspects into product development.

Integrated Wellness: The integration of physical and emotional aesthetics is becoming increasingly important. The focus is shifting from merely enhancing physical appearance to considering emotional well-being as well. Scientific advancements allow for the triggering of positive emotional states through environmental and sensory responses, leveraging the skin’s hormonal system. This holistic approach to wellness, encompassing physical, emotional, and mental aspects, represents the next frontier in the neurotech wellness domain.

P.S. I utilized some of the following sources to obtain the data for this article:

(1) Unilever (2) WWD (3) Business of Fashion (4) Investmentsreports (5) Beautymatter (6) Crunchbase

Other topics that might pique your interest 💡📍 12 Innovations To Improve The Gut-Brain Connection

The human gut serves as the habitat for trillions of microorganisms, not limited to the stomach but also extending to the intestines, throat, mouth, skin, eyes, and nasal passages. 👉 Click here to read the full article.

📍25 Startups Transforming The Weight-Loss Landscape

Barclays predicts that the obesity drug industry could reach a staggering value of $200 billion within the coming decade. 👉 Click here to read the full article.

The contents of this newsletter have the potential to influence those around you. Feel free to share it.

+ Health-Tech innovation is good