"D2C" Health Giant: A Look Inside VIOME Growth Strategy

How VIOME is building a repeatable and scalable acquisition engine

Growing a Direct-to-Consumer (D2C) health brand comes with its own set of challenges and risks. While the D2C model offers many benefits, including direct access to consumers and the ability to build a strong brand, it also has its drawbacks.

Some of these risks to consider are:

1. Competition: Establishing a long term moat to compete against new entrants, such as leveraging network effects.

2. Value Proposition: Crafting a compelling value proposition in the healthcare sector that fosters consumer trust and credibility, particularly challenging for D2C brands without physical presence or professional endorsements.

3. Unit Economics: Developing a business model with clear avenues for monetization.

3.1 Average Order Value (AOV): Focusing on strategies to boost AOV and/or increase purchase frequency.

3.2 Customer Acquisition Cost (CAC): Devising a pragmatic approach to ensure a positive LTV/CAC > 3 ratio

4. Acquisition: building a repeatable and scalable acquisition engine.

The challenging macroeconomic conditions of last years proved to be a significant obstacle for emerging D2C digital health startups, particularly those in the early stages of their journey, which had to make substantial initial investments in building brand awareness and acquiring customers.

This led me to ponder the strategies that successful D2C Digital Health brands are adopting to sustain their growth. Due to the lack of affordable funding for acquiring customers or a captive audience of pandemic-era buyers, D2C companies had to focus on operational efficiency and the long-term value of their customers. Some companies set themselves apart by introducing new features, expanding their product categories, and forming partnerships to improve consumer value. Others explored opportunities to diversify their revenue streams by engaging in B2B ventures.

In this edition of the newsletter, I'll delve into the growth strategy of Viome. In an upcoming newsletter, I'll delve into the strategies of other companies such as ZOE, Ro.co, and Hims.

Let's explore the growth strategy further:

1. Viome (a Viome Life Sciences Company) - (Washington / US)

Provides a direct-to-consumer healthcare test that analyzes microbial and human gene expressions (mRNA), in order to provide individuals with health insights and the nutrition they need.

The numbers:

Employees: 86

Revenue 2023: €26 million ($29 million in Dealroom)

Total Funding: €161 million and was last valued in 2022 at €312 million (multiple of 12x the revenue, not bad )

Total Test performed: 350,000 from consumers in 106 countries (primarily the U.S., U.K., Canada and Australia)

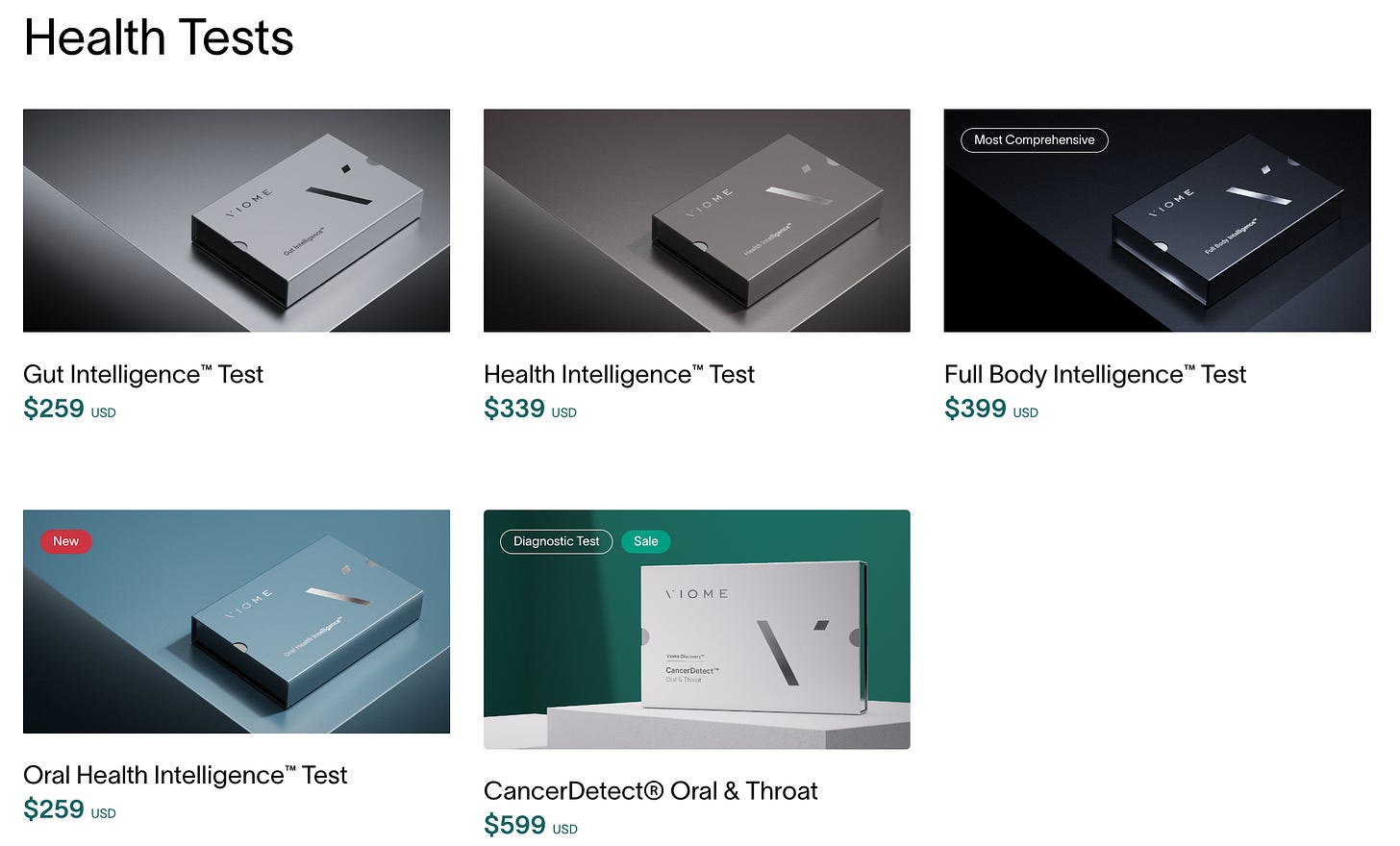

Pricing: Gut Health Solutions from €73/mo ( Test + Probiotics & Prebiotics)

Growth Strategy: Viome employs diverse channels, both digital and physical, to enhance its expansion.

Online:

-Influencers & Affiliate Marketing: Viome has implemented a User-Generated Content strategy, partnering with celebrities and influencers at the micro and medium-tier levels. The company has capitalized on these endorsements by featuring a dedicated link on its website, offering special discounts to individuals who are introduced to the brand through these influencers. Notable examples include Paris Hilton and actor Tom Hopper. Affiliate Program: Viome offers a 15% commission to its affiliates, with an average order value (AOV) of €165.

-E-mail Marketing: Taking advantage of the great interest of consumers in VIOME products, the company nurtures them, via email marketing, with relevant content, webinars and events.

-Performance Marketing: A large amount of the capital raised is allocated to advertising on Facebook, Instagram and other social networks.

Viome’s Biggest Advocates

Offline:

-Partnerships (Retail): The pharmacy chain CVS plans to introduce Viome tests in approximately 200 stores across the United States. The collaboration works as follows: CVS is purchasing kits in a wider revenue share agreement.Product & Inorganic Growth:

-Product category expansion: Viome will use its last funding of €80 million to develop new product lines around mouth and dental health (Oral Health Test + Supplements from €63,5/mo).

-Acquisitions / Inorganic growth: In line with the expansion of new product categories, Viome acquired Naring Health in 2023, enhancing its personalized medicine offerings. Additionally, in 2019, Viome acquired Habit, a prominent personalized nutrition company owned by Campbell Soup Company (NYSE:CPB)

The truth is that in D2C, the acquisition cost only tends to get worse over time. Increasing CAC, plus robust personnel structures required to handle growth have contributed to the challenge of achieving profitability.

Despite this, there appears to be a promising opportunity for D2C Digital Health companies to diversify their product offerings and minimize these expenses by leveraging their established customer base. For instance, Viome initially focused on gut health tests and supplements, but is now venturing into oral health and longevity solutions. Similarly, companies like Ro.co and Hims have successfully expanded from sexual health to hair growth and mental health services.

+ Health-Tech innovation is good

P.S. I used some of the following sources to obtain the data for this article:

(1) Viome.com (2) Dealroom (3) Crunchbase (4) Techcrunch

Other topics you might find interesting 💡📍 Europe in 2040: The Future Of Health

Europe needs a fresh perspective on healthcare. 👉 Click here to read the full article.

📍Don't Die: The Rise of Longevity Technology

As people increasingly seek to delay the aging process and extend their healthspan, a notable business opportunity is emerging for companies to introduce innovative products and services in this field. 👉 Click here to read the full article.

The contents of this newsletter have the potential to influence those around you. Feel free to share it.